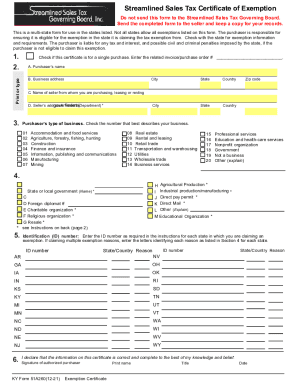

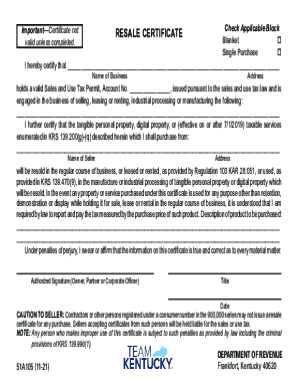

KY DoR 51A126 2009-2024 free printable template

Get, Create, Make and Sign

How to edit ky tax exempt form pdf online

How to fill out ky tax exempt form

How to fill out 51a126?

Who needs 51a126?

Video instructions and help with filling out and completing ky tax exempt form pdf

Instructions and Help about purchase exemption certificate form

Hi I'm mark for attacks calm the state of Kentucky collects taxes by variable rates from the first three thousand dollars in income tax at a rate of two percent any income over 75,000 one dollar is taxed at a rate of six percent Social Security benefits are not taxed in Kentucky if you have retirement income up to forty 1110 dollars you may be excluded from paying taxes this includes monies distributed from IRAs 401 k plans private pensions as well as annuities if you receive a pension from military service civil service or a state or local government you may qualify for additional exclusions you are considered a resident of Kentucky if you hold a domicile on the last day of the tax year in the state this includes a person who spends over 183 days in Kentucky and hold a place of residence in the state all other persons are considered non-residents the state of Kentucky holds a reciprocal tax agreement with the following states Indiana Illinois Michigan Ohio Virginia West Virginia and Wisconsin this means that any income earned in the state of Kentucky by residents of the above states are exempt from paying state income tax if you are a resident of Kentucky and earn income in one of the reciprocal States you are exempt from paying state income tax to the state in which you are employed for more information go to eat acts calm

Fill kentucky purchase exemption certificate : Try Risk Free

People Also Ask about ky tax exempt form pdf

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ky tax exempt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.